Fears of latest commerce tensions with China drive essential indexes decrease.

Wall Road’s prime indices fell as a rebound in tech shares tumbled, including to losses triggered by fears of latest commerce tensions.

After a blended day on European fairness markets, losses on Wall Road had been broad-based on Thursday, with vitality the one one in all 11 industrial sectors to advance within the S&P 500.

The Dow, which had notched data the final three days, led main indices decrease with a 1.3 % drop.

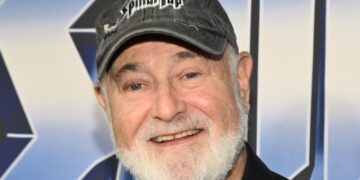

“It doesn’t take a lot of an excuse for markets to take some earnings after they’ve had such a very good run,” stated Artwork Hogan, chief market strategist at B Riley Wealth.

Market watchers have for days fixated on the “overbought” state of tech shares after outsized features by synthetic intelligence shares thus far in 2024.

The “VIX” volatility index rose by about 10 % in a transfer that some tied to political strain constructing on US President Joe Biden to exit the 2024 marketing campaign.

Spartan Capital’s Peter Cardillo stated hypothesis about Biden “may create some short-term election nervousness” after extra traders anticipated a win by Donald Trump following the June presidential debate.

Europe’s main inventory markets ended the day blended, with London getting a lift from the day gone by’s oil worth surge.

Oil costs had vaulted 2 % increased on Wednesday after indicators of strengthening crude demand in prime client america, although the market stabilised on Thursday.

The greenback firmed following losses attributable to rising expectations that the US Federal Reserve would minimize rates of interest no less than as soon as this 12 months.

As anticipated, the European Central Financial institution (ECB) on Thursday stored its key rates of interest regular because it waits for agency indications that client worth rises are steady earlier than lowering borrowing prices once more.

The financial institution stored the important thing deposit price at 3.75 % after the primary minimize in June ended an unprecedented streak of hikes to tame runaway inflation.

However ECB chief Christine Lagarde stated there was no predetermined price path and that the choice at September’s assembly was “broad open” and would depend on the info.

On Wednesday, tech companies took a success after a report stated US President Joe Biden would goal firms supplying China with key semiconductor know-how.

Biden is reportedly taking a look at imposing strict curbs on firms together with Tokyo Electron and Dutch agency ASML in the event that they proceed permitting Beijing entry to their chip tech.

Sentiment was additionally dented by Trump’s feedback that essential chip provider Taiwan – residence to TSMC and different main producers – ought to pay the US for serving to the island defend itself militarily towards China.