Getty Pictures

Getty PicturesHeavy snow blends into white thick clouds in Skellefteå, a riverside metropolis in northern Sweden that’s house to 78,000 residents.

It is also the situation of what was imagined to grow to be Europe’s largest and greenest electrical battery manufacturing facility, powered by the area’s abundance of renewable power.

Swedish start-up Northvolt opened its flagship manufacturing plant right here in 2022, after signing multi-billion euro contracts with carmakers together with BMV, Volkswagen and Nordic truck producer Scania.

Nevertheless it bumped into main monetary troubles final 12 months, reporting money owed of $5.8bn (£4.6bn) in November, and submitting for chapter within the US, the place it had been hoping to develop its operations.

Since September it is laid off round 1 / 4 of its international workforce together with greater than 1,000 workers in Skellefteå.

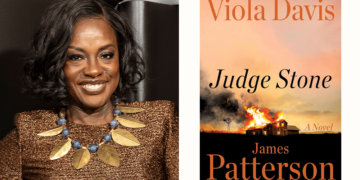

“Lots of people have moved out already,” says 43-year-old Ghanaian Justice Dey-Seshie, who relocated to Skellefteå for a job at Northvolt, after beforehand finding out and dealing in southern Sweden.

“I have to safe a job with a view to lengthen my work allow. In any other case, I’ve to exit the nation, sadly.”

Maddy Savage

Maddy SavageMany researchers and journalists monitoring Northvolt’s downfall share the view that it was at the very least partly brought on by a world dip in demand for electrical automobiles (EVs).

In September Volvo abandoned its target to solely produce EVs by 2030, arguing that “clients and markets are transferring at completely different speeds”. In the meantime China, the market chief in electrical batteries, has been capable of undercut Northvolt’s costs.

Lacking manufacturing targets (a key consider BMW pulling out of a €2bn deal in June), increasing too rapidly, and the corporate’s management have additionally been broadly cited as components fuelling the disaster.

“To construct batteries is a really complicated course of. It takes quite a lot of capital, it takes time, and so they clearly simply did not have the appropriate personnel operating the corporate,” argues Andreas Cervenka, a enterprise writer and economics commentator for Swedish each day Aftonbladet.

At Umeå college, Madeleine Eriksson, a geographer researching the affect of so-called “inexperienced industries” says Northvolt offered a “save the world mentality” that impressed buyers, media and native politicians.

However this “now-or-never” strategy, she argues, glossed over the actual fact it was a risk-taking start-up that “by no means completed attracting funding”.

Northvolt didn’t reply to a number of requests from the BBC to reply to feedback about its downfall or future plans.

The agency has employed German Marcus Dangelmaier, from international electronics firm TE Connectivity to run Northvolt’s operations in Skellefeå, from January, because it seeks to draw contemporary funding.

Northvolt’s co-founder and CEO Peter Carlsson – a former Tesla govt – resigned in November.

Because the postmortem into the disaster continues, there are debates concerning the potential affect on Sweden’s inexperienced ambitions.

Northern Sweden, dubbed the “Nordic Silicon Valley of sustainability” by consultancy firm McKinsey, has swiftly gained international repute for brand new industries designed to fast-track Europe’s inexperienced transition.

The area is a hub for biotech and renewable power. Alongside Northvolt, excessive profile corporations embody Stegra (previously referred to as H2 Inexperienced Metal) and Hybrit, that are each creating fossil-free gas utilizing hydrogen.

However Mr Cervenka, the economics commentator, argues Northvolt’s downfall has broken Sweden’s “superb model” with regards to inexperienced applied sciences.

“There was an enormous alternative to construct this champion, and to construct this Swedish icon, however I believe buyers that misplaced cash are going to be hesitant to take a position once more in an identical challenge within the north of Sweden,” he says.

Some native companies say the publicity round Northvolt’s disaster is already having a detrimental affect.

“I really feel it myself once I journey now – even to the southern components of Sweden – and overseas, that individuals actually ask me questions,” says Joakim Nordin, CEO of Skellefteå Kraft, a serious hydropower and wind power supplier, which was an early investor in Northvolt.

Cleantech Scandanavia

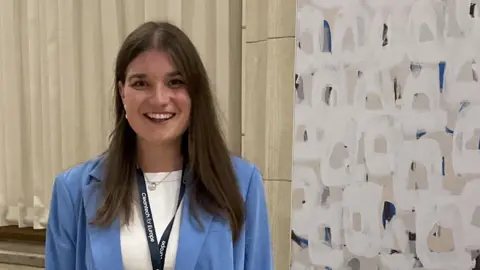

Cleantech ScandanaviaHeadquartered in Malmö in southern Sweden, Cleantech for Nordics is an organisation that represents a coalition of 15 main buyers in sustainability-focussed start-ups.

Right here, local weather coverage analyst Eva Andersson believes the nation’s lengthy legacy as an environmental champion will stay related.

“I believe it will be presumptuous to say that, okay, now we’re doomed right here within the Nordics as a result of one firm has failed,” she argues.

Cleantech for Nordics’ research suggests there have been greater than 200 investments in clear tech initiatives in Sweden in 2023.

Another study by Dealroom, which gathers information on start-ups signifies 74% of all enterprise capital funding to Swedish start-ups went to so-called affect corporations which prioritise environmental or social sustainability, in comparison with a European common of simply 35%.

“Sweden remains to be punching above its weight on this sector. And I believe we might count on it to proceed to take action transferring ahead as nicely,” predicts Anderson.

There are rising requires elevated state help to assist Sweden keep its place. The Swedish authorities refused to bail out Northvolt, suggesting all startups – sustainable or not – must be topic to market forces relatively than bailed out by taxpayers. However as different components of the world ramp up battery manufacturing and different carbon-cutting industries, the choice has confronted a backlash.

“The US and China have huge help packages for inexperienced business, and so they positively are catching up and overtaking in some sectors. And so that’s positively a menace to be reckoned with,” argues Andersson.

Simply 3% of world battery cell manufacturing at present takes place in Europe – according to research for worldwide consultancy agency McKinsey – with Asian corporations main the market.

Getty Pictures

Getty PicturesSweden’s minister for Power, Enterprise and Trade Ebba Busch argues extra EU help relatively than funding from particular person governments is the reply.

Final month she told Swedish television the scenario at Northvolt was “not a Swedish disaster”, relatively a mirrored image of a Europe-wide problem with regards to competitiveness within the electrical battery sector.

However whereas the federal government insists it needs Sweden to play a key position in Europe’s battery business, and the broader inexperienced transition, it has been accused of sending combined messages. The fitting-wing coalition, which got here into energy in 2022 has cut taxes on petrol and diesel, and abolished subsidies for EVs.

“It is a very politically delicate space,” says journalist Cervenka. “The Swedish authorities is being really criticised internationally for not fulfilling its local weather obligations. And that may be a stark distinction to the picture of Sweden as a pioneer.”

The BBC approached Busch’s media workforce, however was not granted an interview.

Skellefteå Kraft

Skellefteå KraftAgain in Skellefteå, the place it has been darkish since simply after lunch, Joachim Nordin is making ready to commute house within the snow.

He says there is a sturdy industrial will for Sweden to stay a inexperienced tech position mannequin, regardless of policymakers being “not as bold” as earlier administrations.

The standards that enticed Northvolt to determine its first manufacturing facility in Skellefteå may also entice different large international gamers to the area, in keeping with the power firm CEO.

“It is 100% nearly renewable power up right here… and that is that is fairly distinctive in the event you examine it to the remainder of Europe. However on prime of that we’re among the many most cost-effective locations on the planet for the electrical energy costs. So in the event you mix these two issues, it is an enormous alternative.”

Skellefeå Kraft just lately introduced a collaboration with Dutch gas firm Sky NRG. Their ambition is to open a big manufacturing facility by 2030, making fossil-free aircraft gas (produced utilizing hydrogen mixed with carbon dioxide captured from biogenic sources).

“The publicity round Northvolt is just not serving to now, in fact. However I hope that that is simply one thing that can be remembered as somewhat bump within the street, once we look again at this 10 years from now,” says Mr Nordin.