China correspondent

A hiss and puff of compressed air shapes the sleek leather-based, bringing to life an all-American cowboy boot in a manufacturing facility on China’s japanese coast.

Then comes one other one because the meeting line continues, the sounds of stitching, stitching, reducing and soldering echoing off the excessive ceilings.

“We used to promote round 1,000,000 pairs of shoes a 12 months,” says the 45-year-old gross sales supervisor, Mr Peng, who didn’t want to reveal his first title.

That’s, till Donald Trump got here alongside.

A slew of tariffs in his first presidential time period triggered a commerce warfare between the world’s two largest economies. Six years on, Chinese language companies are bracing themselves for a sequel now that he’s again within the White Home.

“What path ought to we take sooner or later?” Mr Peng asks, unsure of what Trump 2.0 means for him, his colleagues – and China.

A battle looms

For Western markets which can be more and more cautious of Beijing’s ambitions, commerce has turn out to be a strong bargaining chip – particularly as a sluggish Chinese language economic system depends ever extra on exports. Trump returned on a campaign promise that included crushing tariffs towards Chinese language-made items, and has since threatened a 10% levy that’s anticipated to take impact on 1 February.

He has additionally ordered a overview of US-China commerce – which buys Beijing time and Washington, negotiating room. And for now, harsher rhetoric (and better tariffs) appears to be directed towards US allies reminiscent of Canada and Mexico.

Trump could have pressed pause on the looming battle with Beijing. However many imagine it is nonetheless coming. It is exhausting to search out a precise determine on what number of companies are fleeing China, however main corporations reminiscent of Nike, Adidas and Puma have already relocated to Vietnam. Chinese language companies too have been transferring, reshaping provide chains, though Beijing stays a key participant.

Mr Peng says his boss, who owns the manufacturing facility, has thought-about transferring manufacturing to South East Asia, together with a lot of their opponents.

It might save the agency, however they’d lose their workforce. A lot of the workers are from the close by metropolis of Nantong and have labored right here for greater than 20 years.

Mr Peng, whose spouse died when their son was younger, says the manufacturing facility has been his household: “Our boss is decided to not abandon these workers.”

Xiqing Wang/ BBC

Xiqing Wang/ BBCHe’s conscious of the geopolitics at play, however he says he and his employees are simply making an attempt to make a dwelling. They’re nonetheless reeling from the influence of 2019, when a fourth spherical of Trump tariffs – 15% – hit Chinese language-made client items, reminiscent of garments and footwear.

Orders have since dwindled and workers numbers, as soon as greater than 500, have dropped to only over 200. The proof is within the empty work stations, as Mr Peng exhibits us round.

Throughout him, employees are reducing the leather-based into the proper form handy it to the machinist. They must be exact as a result of errors will spoil the costly leather-based, most of which has been imported from the US.

The manufacturing facility is making an attempt to maintain prices low as a few of their American consumers are already contemplating transferring enterprise away from China and the specter of tariffs.

However that will imply shedding expert employees: it may well take as much as per week to make one pair of shoes, from flattening the leather-based to giving the completed boots a ultimate polish and packing them for export.

That is what turned China into the world’s prime producer – labour-intensive manufacturing which can also be low cost when it is scaled up and supported by an unrivalled provide chain. And this has been years within the making.

“It was as soon as a relentless cycle of inspecting items and delivery them out – I felt fulfilled,” says Mr Peng, who has labored right here since 2015. “However orders have decreased, which makes me really feel fairly misplaced and anxious.”

As soon as crafted to overcome the Wild West, these cowboy boots have been made right here for greater than a decade. And this can be a acquainted story within the south of Jiangsu province, a manfucaturing hub alongside the Yangtze River that produces nearly every thing, from textiles to electrical automobiles.

Xiqing Wang/ BBC

Xiqing Wang/ BBCThese are among the many lots of of billions of {dollars} value of products that China ships to the USA yearly – a quantity that steadily ballooned as Washington grew to become its largest buying and selling companion.

That standing slipped below Trump. Nevertheless it was not restored below his successor Joe Biden, who stored most Trump-era tariffs in place, as ties with Beijing frayed.

In reality, the European Union too has imposed tariffs on electrical car imports, accusing China of constructing an excessive amount of, usually with the help of state subsidies. Trump has echoed this – that China’s “unfair” commerce practices drawback overseas comeptitors.

Beijing sees such rhetoric as Western makes an attempt to stifle its development, and it has repeatedly warned Washington that there will probably be no winners in a commerce warfare. Nevertheless it has additionally mentioned it is prepared to speak and “correctly deal with variations”.

And President Trump, who has described tariffs as his “one massive energy” over China, definitely desires to speak.

It is unclear as but what he may need in return. Throughout Trump’s honeymoon interval with China in his first time period he got here to Beijing to ask for Xi’s assist in meeting North Korea’s leader Kim Jong Un. This time it’s believed he may want Xi’s help to make a cope with Russian President Vladimir Putin to finish the warfare in Ukraine. He just lately mentioned that China had “quite a lot of energy over that state of affairs”.

The specter of a ten% tariff is pushed by the assumption that China is “sending fentanyl to Mexico and Canada”. So he might demand that it do extra to finish that circulation.

Or, given he welcomed a bidding warfare over TikTok, he may want to negotiate its ownership – or the prized know-how that powers the app – as a result of Beijing would wish to comply with any such sale.

Xiqing Wang/BBC

Xiqing Wang/BBCRegardless of the deal could also be, it might assist reset US-China ties. Nevertheless, the absence of 1 might abruptly finish the prospect of a second honeymoon, establishing Trump and Xi for a much more confrontational relationship.

Already enterprise sentiment is nervous: an annual survey by the American Chamber of Commerce in China confirmed simply over half of them have been involved in regards to the US-China relationship deteriorating additional.

Trump’s seemingly softer stance on China gives gives some aid. However his hope remains to be that the specter of tariffs will assist drive consumers away from China and transfer manufacturing again to the US.

Some Chinese language companies are certainly on the transfer – however to not America.

Shifting store

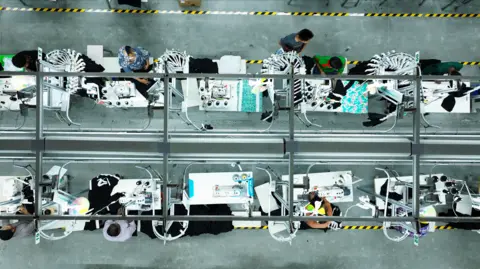

An hour outdoors Cambodia’s capital Phnom Penh, businessman Huang Zhaodong has constructed a brand new manufacturing facility to cater to a flood of orders from US giants Walmart and Costco.

That is his second manufacturing facility in Cambodia, and collectively they produce half 1,000,000 clothes a month, from shirts to underwear. Hangers carrying cotton trousers roll previous us on an automatic line, transferring from one station to the following because the elastic waist is inserted and hemlines are completed.

Xiqing Wang/ BBC

Xiqing Wang/ BBCNow, when potential US prospects lob the primary query, which he has come to count on – the place is he primarily based – Mr Huang has the proper reply. Not in China.

“Within the case of some Chinese language corporations, their prospects have informed them: ‘In the event you do not transfer manufacturing abroad, I am going to cancel your orders’.”

The tariffs increase robust decisions for suppliers and retailers, nevertheless it’s not all the time clear who will bear the brunt of the price. Typically it will likely be the shopper, Mr Huang says.

“Take Walmart for example. I promote them garments at $5, however they often mark it up 3.5 occasions. If the price will increase as a result of increased tariffs, the value I promote to them may rise to $6. In the event that they mark it up by 3.5 occasions, the retail value would improve.”

However often, he says, it’s the provider. If his manufacturing line was in China, he estimates an additional 10% tariff might take an additional $800,000 (£644,000) from his earnings.

“That is greater than what I make as revenue. It is large and we will not afford it. In the event you’re making garments in China below such tariff circumstances, it is unsustainable,” he says.

Present US tariffs on Chinese language items fluctuate from 100% on electrical automobiles to 25% on metal and aluminium. Till now, a number of top-selling objects have been exempt, together with electronics, reminiscent of TVs and iPhones.

However the 10% blanket tariff Trump is proposing might have an effect on the value of every thing that’s made in China and exported to the US. That applies to a number of issues – from toys and tea cups to laptops.

Xiqing Wang/ BBC

Xiqing Wang/ BBCMr Huang says this might encourage extra factories to maneuver elsewhere. A number of new workshops have sprung up round him and Chinese language corporations from textile manufacturing heartlands reminiscent of Shandong, Zhejiang, Jiangsu and Guangdong are transferring in to make winter jackets and woollen clothes.

Round 90% of clothes factories in Cambodia at the moment are Chinese language-run or Chinese language-owned, in response to a report by perception and evaluation group Analysis and Markets.

Half of the country’s foreign investment flows from China. Seventy % of roads and bridges have been constructed utilizing loans Beijing disbursed, in response to Chinese language state media.

Lots of the indicators on eating places and retailers are in Chinese language in addition to Khmer, the native language. There’s even a hoop street named Xi Jinping Boulevard in honour of the Chinese language president.

Cambodia shouldn’t be a lone recipient. China has invested closely in several components of the world below President Xi’s Belt and Road Initiative – a commerce and infrastructure challenge that additionally will increase Beijing’s affect.

Meaning China has decisions.

Chinese language state media claims that greater than half of China’s imports and exports now come from Belt and Highway nations, most of them in South East Asia.

Xiqing Wang/BBC

Xiqing Wang/BBCThis has not occurred in a single day, says Kenny Yao from AlixPartners, who advises Chinese language corporations on methods to cope with tariffs.

Throughout Trump’s first time period, many Chinese language corporations doubted his tariff risk, he informed the BBC. Now they ask if he’ll comply with the provision chain and slap tariffs on different nations.

Simply in case he does, Mr Yao says, it might be smart for Chinese language companies to look additional afield: “For instance, Africa or Latin America. That is tougher, however it’s good to take a look at areas you haven’t explored earlier than.”

As America pledges to take care of itself first, Beijing is doing its finest to seem a secure enterprise companion, and there’s some proof it’s working.

China has edged previous the US to turn out to be the prevailing selection for nations in South East Asia, in response to a survey by the Iseas Yusof-Ishak assume tank in Singapore.

Although manufacturing has moved overseas, cash nonetheless flows to China – 60% of the supplies being made into garments at Mr Huang’s factories in Phnom Penh come from China.

And exports are thriving, with Beijing investing extra closely in high-end manufacturing, from photo voltaic panels to synthetic intelligence. Final 12 months’s commerce surplus with the world – on the again of a virtually 6% year-on-year bounce in exports – was a file $992bn.

Nonetheless, Chinese language companies – in Jiangsu and Phnom Penh – are making ready themselves for an unsure spell, if not a turbulent one.

Mr Peng hopes the US and China can have an “amicable and calm” dialogue to maintain the tariffs “inside an affordable vary” and keep away from a commerce warfare.

“People nonetheless have to buy these merchandise,” he mentioned, earlier than driving off to fulfill new prospects.