Reuters

ReutersBribery costs by a US court docket towards the Adani Group are unlikely to considerably upset India’s clear vitality objectives, trade leaders have instructed the BBC.

Delhi has pledged to supply half of its vitality wants or 500 gigawatts (GW) of electrical energy from renewable sources by 2032, key to international efforts to fight local weather change.

The Adani Group is slated to contribute to a tenth of that capability.

The legal troubles in the US might quickly delay the group’s enlargement plans however is not going to have an effect on the federal government’s general targets, analysts say.

India has made spectacular strides in constructing clear vitality infrastructure during the last decade.

The nation is rising on the “quickest charge amongst main economies” in including renewables capability, based on the Worldwide Vitality Company.

Put in clear vitality capability has grown five-fold, with some 45% of the nation’s power-generation capability – of practically 200GW – coming from non-fossil gas sources.

Fees towards the Adani Group – essential to India’s clear vitality ambitions – are “like a passing darkish cloud”, and won’t meaningfully impression this momentum, a former CEO of a rival agency stated, wanting to stay nameless.

Getty Photographs

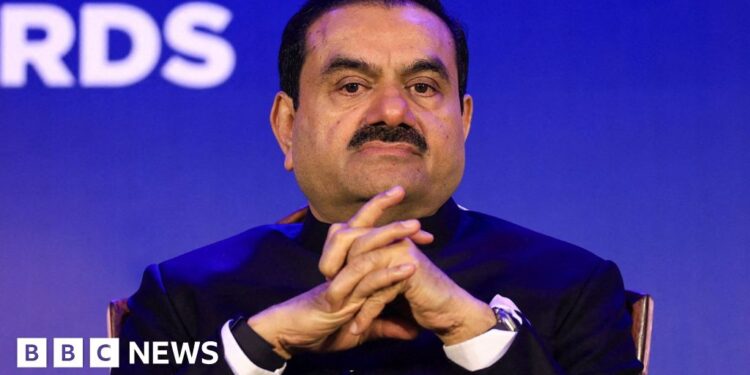

Getty PhotographsGautam Adani has vowed to speculate $100bn (£78.3bn) in India’s vitality transition. Its inexperienced vitality arm is the nation’s largest renewable vitality firm, producing practically 11GW of fresh vitality by a various portfolio of wind and photo voltaic tasks.

Adani has a goal to scale that to 50GW BY 2030, which is able to make up practically 10% of the nation’s personal put in capability.

Over half of that, or 30GW, will likely be produced at Khavda, within the western Indian state of Gujarat. It’s the world’s greatest clear vitality plant, touted to be 5 instances the scale of Paris and the centrepiece in Adani’s renewables crown.

However Khavda and Adani’s different renewables amenities at the moment are on the very centre of the costs filed by US prosecutors – they allege that the corporate gained contracts to provide energy to state distribution corporations from these amenities, in alternate for bribes to Indian officers. The group has denied this.

However the fallout on the firm degree is already seen.

When the indictment grew to become public, Adani Inexperienced Vitality instantly cancelled a $600m bond providing within the US.

France’s TotalEnergies, which owns 20% of Adani Inexperienced Vitality and has a three way partnership to develop a number of renewables tasks with the conglomerate, stated it should halt contemporary capital infusion into the corporate.

Main credit score scores companies – Moody’s, Fitch and S&P – have since modified their outlook on Adani group corporations, together with Adani Inexperienced Vitality, to detrimental. It will impression the corporate’s capability to entry funds and make it costlier to lift capital.

Analysts have additionally raised issues about Adani Inexperienced Vitality’s capability to refinance its debt, as worldwide lenders develop weary of including publicity to the group.

International lenders like Jeffries and Barclays are already stated to be reviewing their ties with Adani even because the group’s reliance on international banks and worldwide and native bond points for long-term debt has grown from barely 14% in monetary 12 months 2016 to almost 60% as of date, based on a observe from Bernstein.

Japanese brokerage Nomura says new financing would possibly dry up within the brief time period however ought to “step by step resume in the long run”. In the meantime, Japanese banks like MUFG, SMBC, Mizuho are prone to proceed their relationship with the group.

The “reputational and nostalgic impression” will fade away in just a few months, as Adani is constructing “strong, strategic property and creating long-term worth”, the unnamed CEO stated.

Getty Photographs

Getty PhotographsA spokesperson for the Adani Group instructed the BBC that it was “dedicated to its 2030 targets and assured of delivering 50 GW of renewable vitality capability”.

Adani shares have recovered sharply from the lows they hit publish the US court docket indictment.

Some analysts instructed the BBC {that a} potential slowdown in funding for Adani might in reality find yourself benefitting its rivals.

Whereas Adani’s monetary affect has allowed it to quickly broaden within the sector, its rivals akin to Tata Energy, Goldman Sachs-backed ReNew Energy, Greenko and state-run NTPC Ltd are additionally considerably ramping up manufacturing and technology capability.

“It isn’t that Adani is a inexperienced vitality champion. It’s a large participant that has walked each side of the road, being the largest non-public developer of coal crops on the earth,” stated Tim Buckley, director at Local weather Vitality Finance.

A big entity, “perceived to be corrupt” presumably slowing its enlargement, might imply “extra money will begin flowing into different inexperienced vitality corporations”, he stated.

In line with Vibhuti Garg, South Asia director at Institute for Vitality Economics and Monetary Evaluation (IEEFA), market fundamentals additionally proceed to stay robust with demand for renewable vitality outpacing provide in India – which is prone to maintain the urge for food for large investments intact.

What might in reality gradual the tempo of India’s clear vitality ambitions is its personal forms.

“Firms we observe are very upbeat. Finance is not an issue for them. If something, it’s state-level laws that act as a type of deterrent,” says Ms Garg.

Getty Photographs

Getty PhotographsMost state-run energy distribution corporations proceed to face monetary constraints, choosing cheaper fossil fuels, whereas dragging their toes on signing buy agreements.

In line with Reuters, the controversial tender gained by Adani was the primary main contract issued by state-run Photo voltaic Vitality Corp of India (SECI) and not using a assured buy settlement from distributors.

SECI’s chairman instructed Reuters that there are 30GW of operational inexperienced vitality tasks out there with out patrons.

Consultants say the 8GW photo voltaic contract on the coronary heart of Adani’s US indictment additionally sheds gentle on the messy tendering course of, which required solar energy technology corporations to fabricate modules as properly – limiting the variety of bidders and resulting in larger energy prices.

The court docket indictment will definitely result in a “tightening of bidding and tendering guidelines”, says Ms Garg.

A cleaner tendering course of that lowers dangers each for builders and buyers will likely be vital going forward, agrees Mr Buckley.

Comply with BBC Information India on Instagram, YouTube, Twitter and Facebook.